Irs Mileage Rate 2024 California State

Irs Mileage Rate 2024 California State. According to irs data, in 2023, the mileage rate for employing a vehicle for business purposes was 65.5 cents per mile. Participants get $100 at the beginning, $100 at the end, and $200 if they pay all of their.

Posted on march 12, 2024. In 2024, the rate increased by.

The Standard Mileage Rates For 2024 Are As Follows:

You may also be interested in.

The California State University Mileage Rate For Calendar Year 2024 Will Be 67 Cents Per Mile, Which Is An Increase From The 2023 Rate Of 65.5 Cents Per Mile.

New standard mileage rates are:

The Irs Bumped Up The Optional Mileage Rate To 67 Cents A Mile In 2024 For Business Use, Up From 65.5 Cents For 2023.

Images References :

Source: koralleweve.pages.dev

Source: koralleweve.pages.dev

What Is The Mileage Rate For 2024 In California Godiva Ruthie, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023 internal revenue service (irs). The 2023 mileage rate was 65.5 cents per mile driven for business use.

.png) Source: www.everlance.com

Source: www.everlance.com

IRS Mileage Rates 2024 What Drivers Need to Know, Irs boosts mileage rate for 2024. To view the press release in its entirety click on.

Source: cardata.co

Source: cardata.co

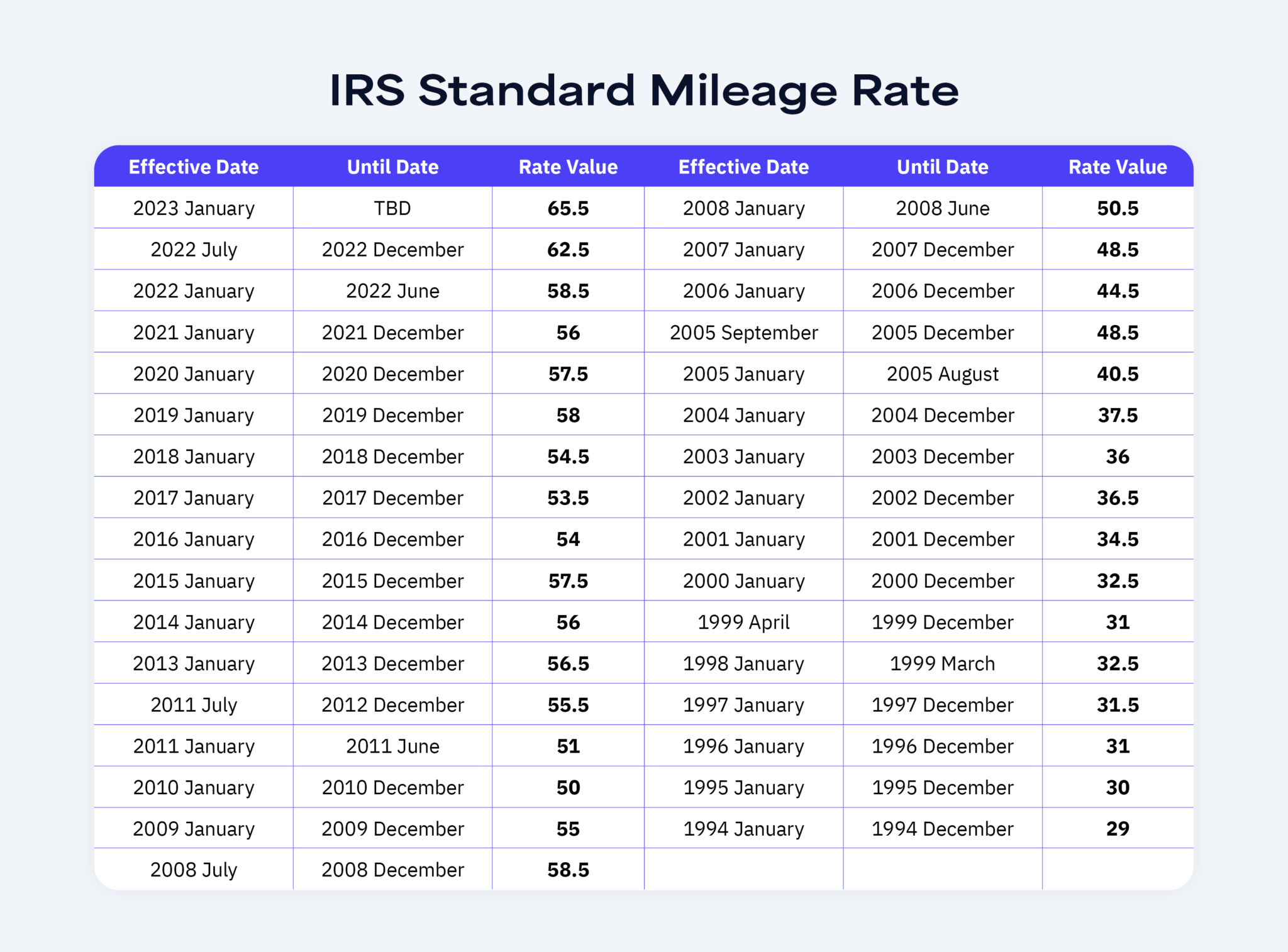

History Of The IRS Standard Mileage Rate 1994 To 2024 Cardata, Current mileage reimbursement rate 2024 ohio. April 18, 2024 2:38 am.

/medriva/media/post_banners/content/uploads/2023/12/irs-2024-standard-mileage-rates-20231216051023.jpg) Source: medriva.com

Source: medriva.com

Understanding the 2024 IRS Standard Mileage Rates, According to irs data, in 2023, the mileage rate for employing a vehicle for business purposes was 65.5 cents per mile. The standard mileage rates for 2024 are as follows:

Source: taxfully.com

Source: taxfully.com

What is the IRS mileage rate for 2024 Taxfully, Mileage rate increases to 67 cents a mile, up 1.5 cents from 2023 internal revenue service (irs). Find standard mileage rates to.

Source: www.youtube.com

Source: www.youtube.com

2023 IRS Standard Mileage Rate YouTube, While minimum wages are increasing, the irs gave employees who drive for company business another present this holiday season: The standard mileage rates for 2024 are as follows:

Source: bkpweb.com

Source: bkpweb.com

The IRS has released the standard mileage rates for 2024., Find answers to your questions about mileage reimbursement in california, ensuring compliance with state regulations and fair compensation. For 2024, the irs' standard mileage rates are $0.67 per mile for business, $0.21 per mile for medical or moving, and $0.14 per mile.

Source: impous.com

Source: impous.com

Free Mileage Log Templates Smartsheet (2022), It’s expected that the irs will set a new rate. To view the press release in its entirety click on.

Source: www.koamnewsnow.com

Source: www.koamnewsnow.com

IRS increases mileage rate for remainder of 2022 Local News, Participants get $100 at the beginning, $100 at the end, and $200 if they pay all of their. At the end of last year, the internal revenue service published the new mileage rates for 2024.

Source: www.hrmorning.com

Source: www.hrmorning.com

2023 standard mileage rates released by IRS, The california state university will adhere to irs guidelines for a standard mileage rate for business travel occurring on or after january 1, 2024. In california, employers are required to fully reimburse you when you use your.

California’s Labor Commissioner Considers The Irs Mileage Reimbursement Rate To Be “Reasonable” For Purposes Of Complying With Lc 2802.

The standard mileage rates for 2024 are as follows:

December 14, 2023 | Kathryn Mayer.

Current mileage reimbursement rate 2024 ohio.